June 24, 2024

By 2022, the global digital health market was valued at approximately $252 billion and is projected to reach $596 billion by 2027 (Global market Insights). AI, in particular, holds immense potential in the healthcare field, paving the way for significant advancements in diagnosing, treating, and managing diseases. It is set to expand from $6.9 billion in 2021 to $67.4 billion by 2027, at a CAGR of approximately 46% (MarketsandMarkets).

However, over the past decade, many new healthcare software companies have struggled in a tough market. On the one hand, patients-oriented startups operate in a heavily regulated market, with challenging business models often based on reimbursement. On the other hand, startups targeting healthcare professionals sometimes face complicated sales cycles due to a fragmented market (public/private/clinics, various sectors, etc.), with professionals relying on old-fashioned software they trust and are accustomed to, resulting in complicated sales cycles to change their methods and tools.

Despite these challenges, some digital health companies have found success by riding the wave of regulatory changes, and focusing on specific areas of care 🏄♀️

Healthcare tasks are particularly intricate and demand precision, posing significant technical challenges… but also offering substantial impact potential! Either because of task complexities, costly mistakes or time-consuming missions, AI is proving to be a game-changer in the realm of enterprise healthcare, with highly favorable use cases for it since:

In a nutshell, there’s today an extremely promising context for AI solutions, which companies must succeed in developing and training in order to get enough credibility and legitimacy!

Each segment represented in our mapping is a promising avenue for startups to leverage AI, offering a competitive advantage and a viable business model in the evolving healthcare landscape.

Let’s have a quick focus on reimbursement as it’s often a target to reach for healthtech startups.

If you’re into digital health and startups, you’ll love what’s happening in France right now. There’s a lot of buzz around how startups are getting reimbursed, thanks to programs like PECAN and Digital Therapeutics (DTx). These pathways are critical for ensuring their innovations reach patients and become financially sustainable. Let me break it down for you.

PECAN (Programme Expérimental pour les Conditions de l’Accès au Numérique en Santé) is a promising program the French government rolled out to help digital health startups. It’s like a fast track for getting your health tech ideas tested and paid for. Here’s the deal:

Basically, with PECAN, startups get provisional coverage, meaning they can get paid while their tech is still being evaluated. This approach not only reduces the financial risks for innovators but also accelerates the adoption of promising technologies within the healthcare system.

Digital Therapeutics (DTx) represent an emerging sector within digital health, focusing on evidence-based therapeutic interventions driven by high-quality software programs. Think of them as high-tech treatments delivered through software. Here’s how it works in France:

N.B.: digital therapies are not necessarily DTx: it still remains a long process to get the certification.

Let’s compare how France and the US handle this whole reimbursement thing. The centralized and collaborative nature of France’s approach contrasts with the more fragmented and market-driven US model, highlighting the importance of tailored strategies for startups aiming to succeed in different regulatory environments.

The FDA (Food and Drug Administration) is super important to know if you're into health and tech. It’s the agency that makes sure all their drugs, medical devices, and food are safe and effective. They’re basically the gatekeepers of health subjects in the US. What’s really interesting is they have programs to speed up the approval process for groundbreaking therapies and devices. This means new and innovative treatments can get to people faster. Compared to other countries with more centralized systems, the FDA's approach helps new tech hit the market quicker.

To make it short, France has a centralized healthcare system: one payer (Assurance Maladie), one set of rules setting stringent national standards for reimbursement. This single-payer system facilitates nationwide implementation of reimbursement policies. Programs like PECAN are all about improving public health. It’s less about making money and more about helping people.

On the contrary, in the US, there’s not ‘one big system’. The US system is indeed like a puzzle with a lot of pieces: multiple private insurers and state-specific Medicaid programs, complicating the reimbursement landscape. And those reimbursement decisions are often driven by market dynamics. That’s why negotiations between insurers and healthcare providers can lead to variability in coverage. Therefore, startups must navigate a complex web of payers, including private insurers, and public Medicare, Medicaid, each with its own criteria and processes for reimbursement.

The centralized way of handling healthcare in France makes it quite long for startups targeting reimbursement. On the other hand, the US, with its numerous private insurers, each having its own criteria for coverage, offers a different landscape. If one insurer denies reimbursement, a startup can approach another, increasing the chances of finding a payer willing to cover the innovation. However, let’s not over simplify the process: navigating the US system is also very complex and challenging.. Expanding too soon to the US could also make startups lose ground in Europe, and spreading themselves too thin. It is necessary that European startups clearly define their geographic roadmaps to evaluate if expanding across the Atlantic is relevant, and when.

We’re super excited to share our analysis of the sector as a generalist fund that has been investing in the sector (hi @Callyope @Via Sana @Sophia Genetics @Withings 👋) .

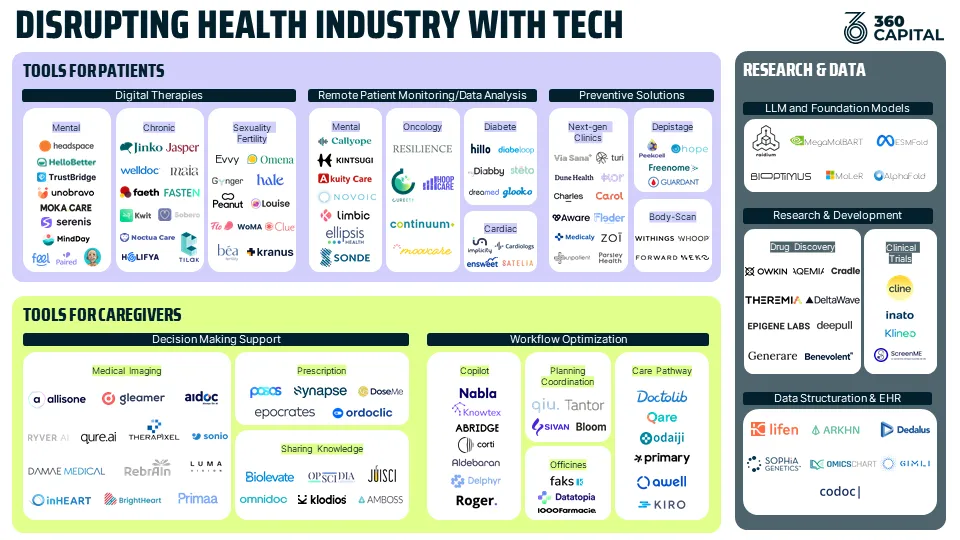

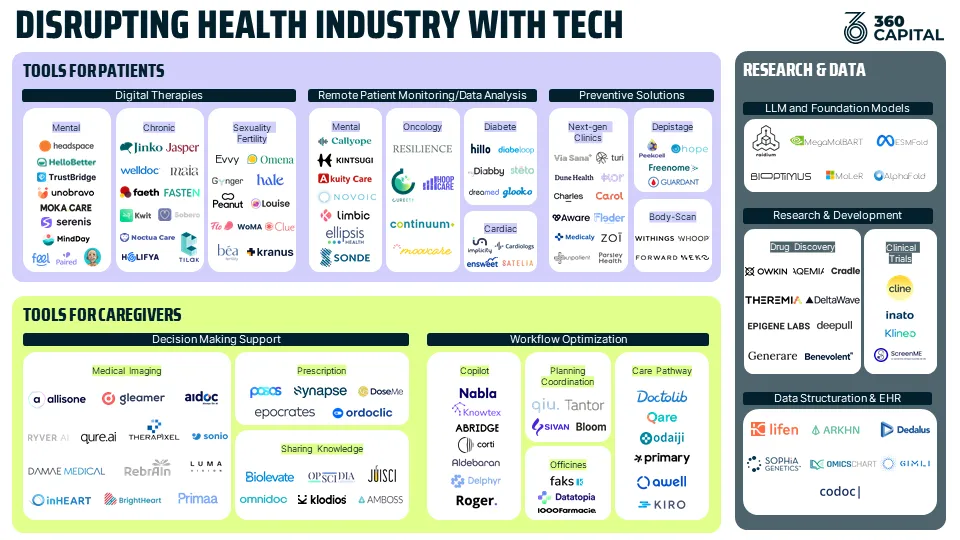

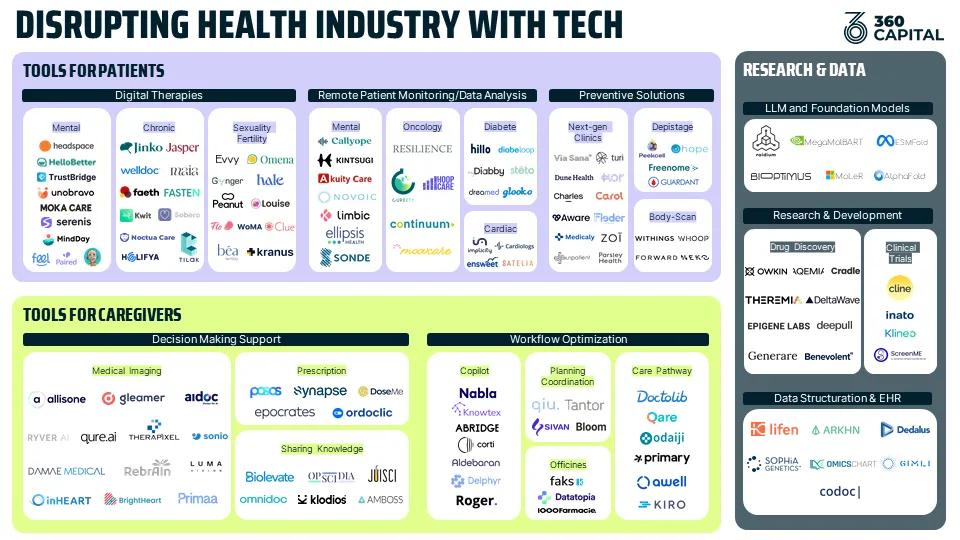

We’ve chosen to cover Europe in general in this mapping, with a strong emphasis on the French startup ecosystem and mentioning some US tech giants that couldn’t be ignored. Here is how we structured things:

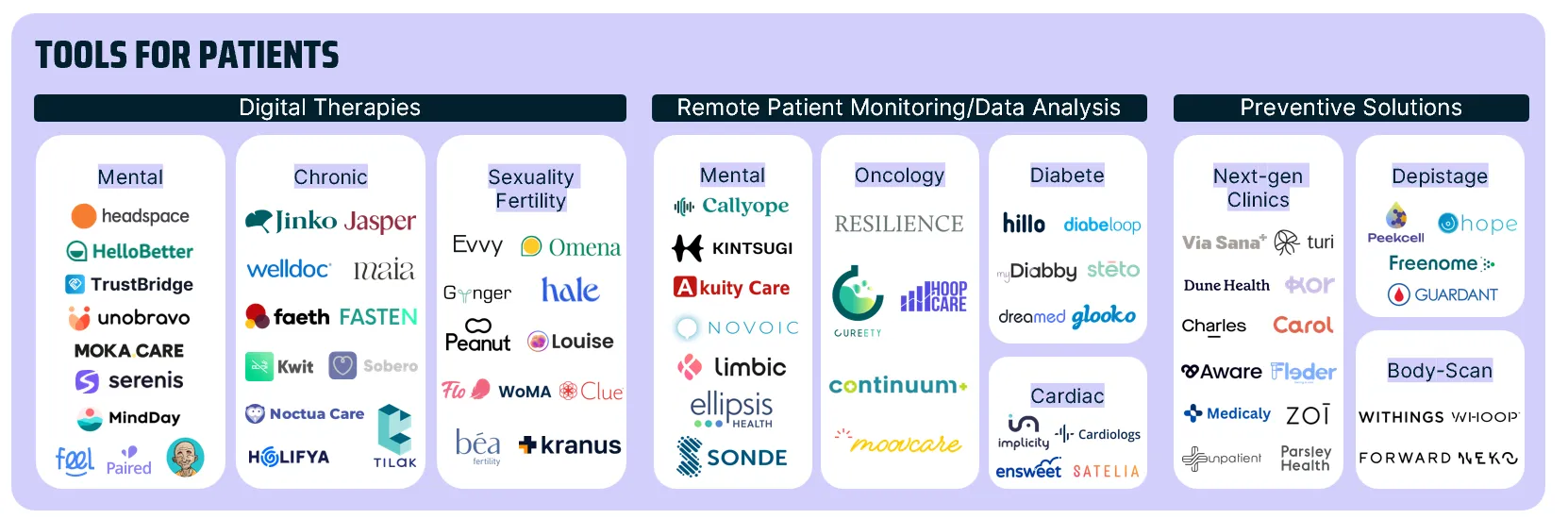

Tech has greatly enhanced patient access to superior solutions and treatments. Through telemedicine, mobile health apps, and wearable devices, patients now have unprecedented access to personalized care, remote consultations, and real-time health monitoring, improving both the quality and accessibility of healthcare services.

⇒ We especially tried to underline the booming sector of specialized solutions per sector, mental health and oncology being the most addressed.

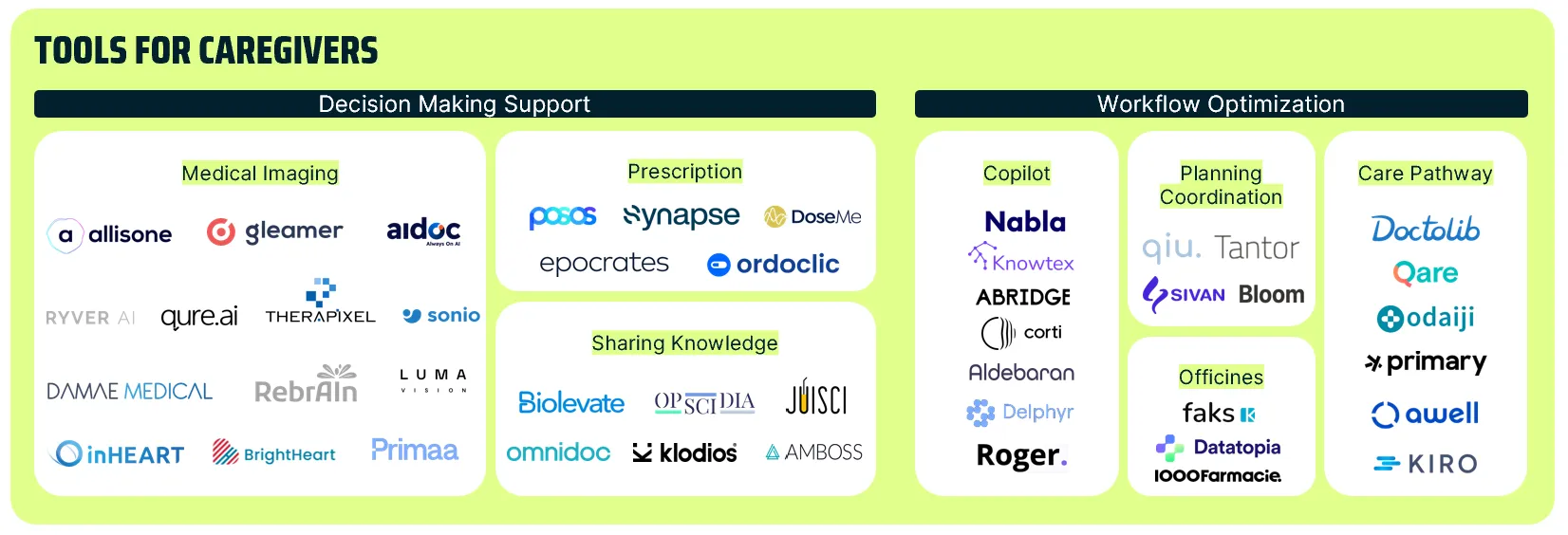

Technology is also empowering caregivers by equipping them with advanced tools that enable quicker and more informed decision-making. Electronic Health Records (EHRs), AI-driven diagnostic tools, and copilot systems streamline administrative tasks, reduce errors, and facilitate data-driven clinical decisions - thus improving overall efficiency and patient outcomes.

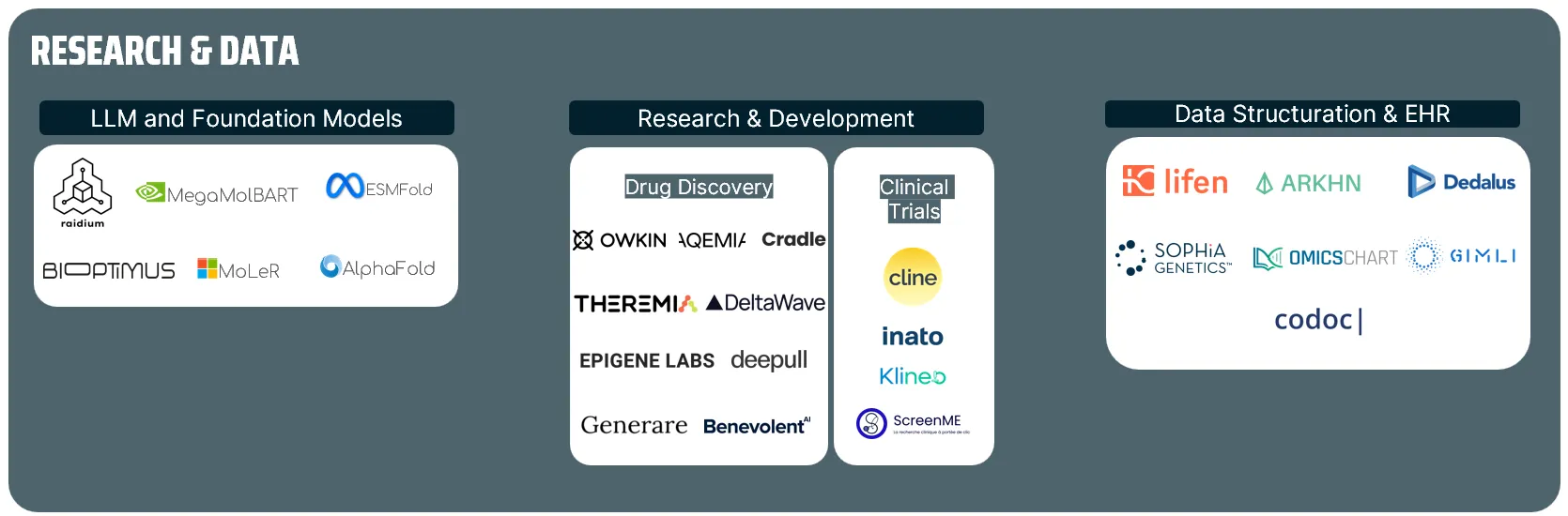

Lastly, from a research and development (R&D) perspective, technology has revolutionized data processing and analysis. Big data analytics, machine learning algorithms, and cloud computing have accelerated the discovery of new medications and treatment methodologies. These technologies, empowered by the structuring of vast datasets make them more readable thereby fostering innovation and expediting the development of cutting-edge medical solutions.

⇒ We notably chose to highlight the upraising of foundation models helping scientists understand proteins, small molecules, DNA, and biomedical text.